Auto Insurance in and around Eugene

Eugene's first choice car insurance is right here

Put it into drive, wisely

Would you like to create a personalized auto quote?

Insure For Smooth Driving

When it comes to economical car insurance, you have plenty of choices. Sorting through savings options, deductibles, coverage options… it’s a lot, to say the least.

Eugene's first choice car insurance is right here

Put it into drive, wisely

Get Auto Coverage You Can Trust

But not only is the coverage terrific with State Farm, there are also multiple options to save. This can range from safe driver savings like the good driver discount to safe vehicle discounts like an anti-theft discount. You could even be eligible for more than one of these options! State Farm agent Seth Yost would love to identify which you may be eligible for and help you create a complete policy that's right for you.

This can include coverage for a variety of situations and vehicles, too, like teen driver coverage, antique or classic cars or rental car coverage. And the benefits of State Farm don't stop there! When mishaps occur, you can be sure to receive straightforward considerate care from State Farm agent Seth Yost. Reach out to Seth Yost's office today!

Have More Questions About Auto Insurance?

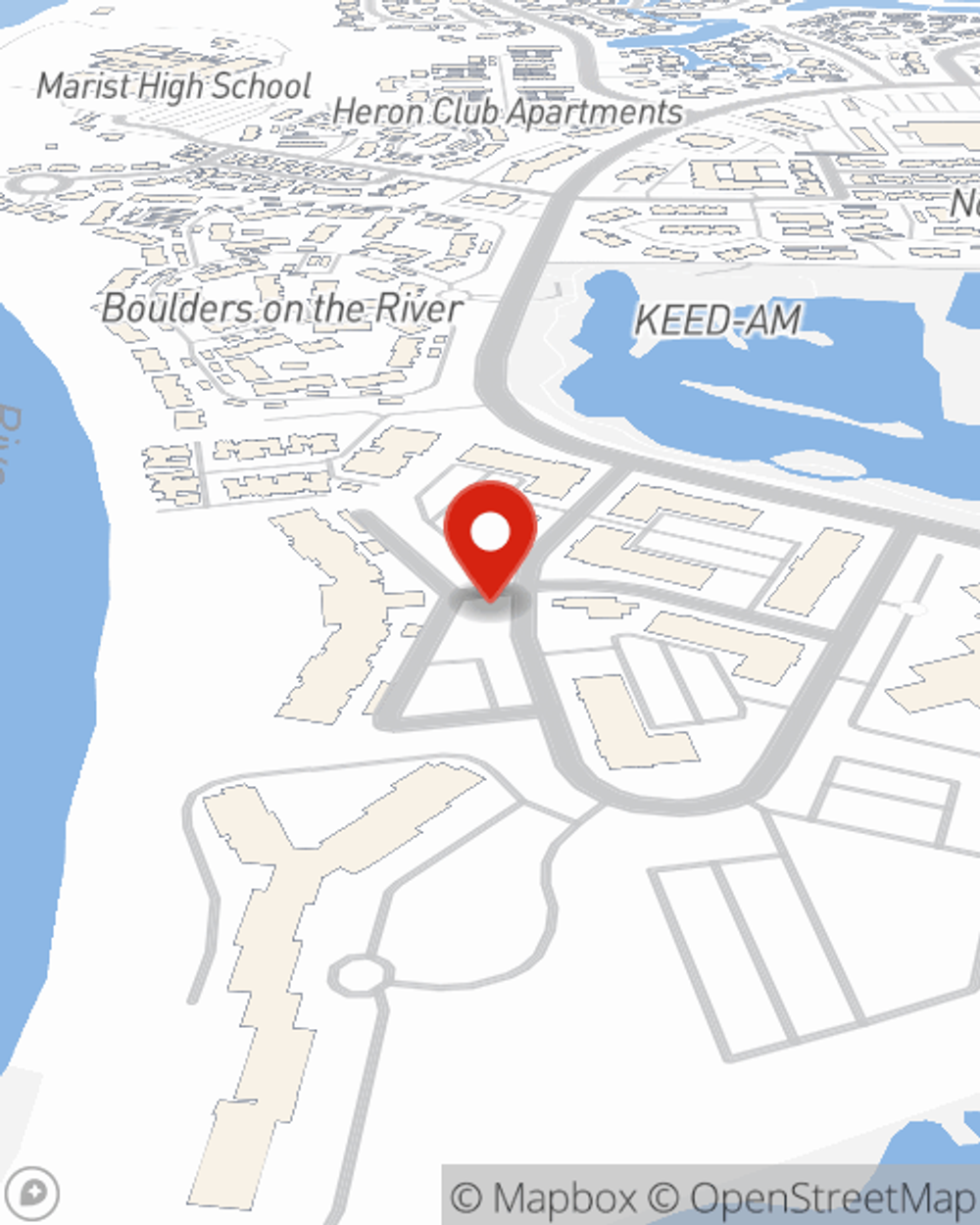

Call Seth at (541) 485-1315 or visit our FAQ page.

Simple Insights®

Golf cart safety tips

Golf cart safety tips

From golf courses to campgrounds, golf carts are a fun and easy way to get around. Keep these safety tips in mind while enjoying your ride.

What is rental car coverage and how does it work?

What is rental car coverage and how does it work?

Understand your options before getting rental car insurance through a rental car company. Double check whether you’re already covered or if it’s necessary to purchase more coverage.

Simple Insights®

Golf cart safety tips

Golf cart safety tips

From golf courses to campgrounds, golf carts are a fun and easy way to get around. Keep these safety tips in mind while enjoying your ride.

What is rental car coverage and how does it work?

What is rental car coverage and how does it work?

Understand your options before getting rental car insurance through a rental car company. Double check whether you’re already covered or if it’s necessary to purchase more coverage.